GenuTax Standard - Program Help - Using NETFILE to Send Your Tax Return

NETFILE is an electronic tax-filing service provided by the Canada Revenue Agency (CRA). The service allows you to file your tax return directly to the CRA using the Internet.

In addition to the 2024 tax return, if you have not already filed your tax return for 2017, 2018, 2019, 2020, 2021, 2022, and/or 2023, you may also use GenuTax Standard to file your tax return for any of these years over the Internet using NETFILE, if your tax return is otherwise eligible.

Here is a detailed set of step-by-step instructions for using NETFILE in GenuTax Standard:

-

Complete the interview

for your tax return. Near the end of the interview, in the section, "Filing the Tax Return", answer "Yes" to the question:

"Would you like to use NETFILE to send your tax return over the Internet?"

- Continue through the next few steps of the interview, reading the information and answering the questions presented to you.

-

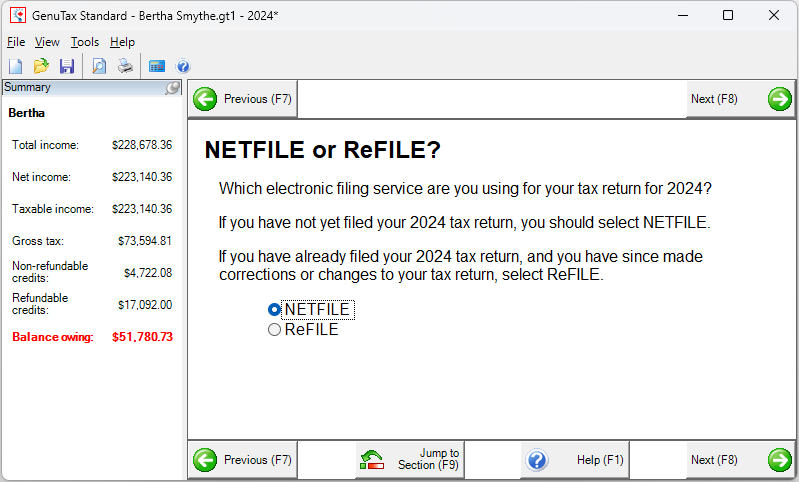

After a few steps, you will be asked whether you want to use NETFILE or ReFILE:

If you have not yet filed your tax return for this specific year, select "NETFILE". If you have already used NETFILE for this tax return year, but you have gone back and made changes, and you wish to file your changed tax return, select "ReFILE".

-

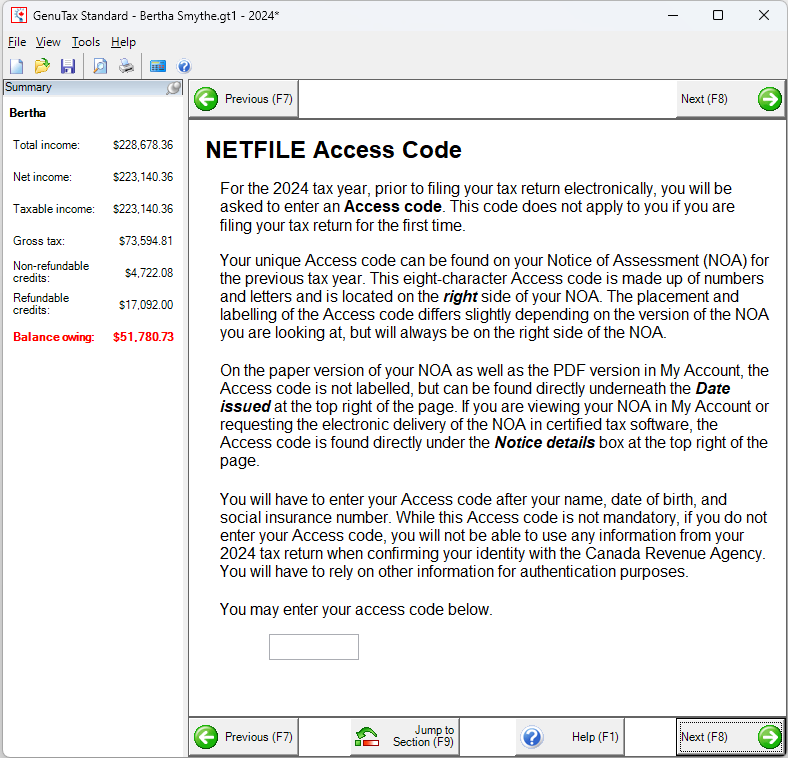

On the next step, if you did not enter your NETFILE Access Code near the beginning of the interview, you are asked to enter it now.

-

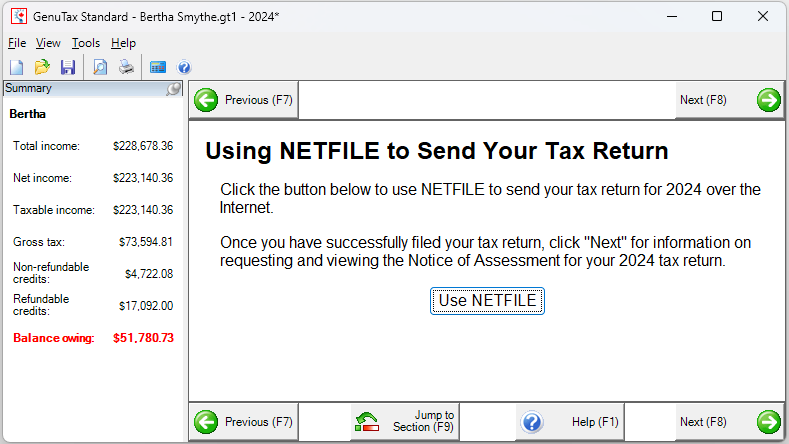

To launch the process of using NETFILE for your tax return, click the "Use NETFILE" button.

-

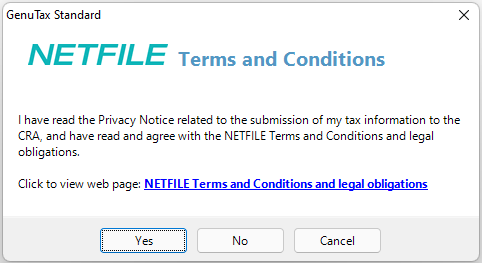

You are asked to review the terms and conditions for using NETFILE. Click the web page link to view and

read the CRA document.

To agree with these terms and conditions, and proceed to send your tax return to the CRA using NETFILE, click the "Yes" button.

-

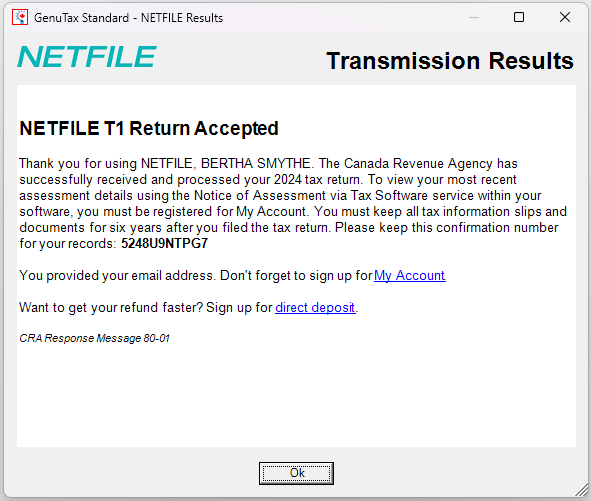

If the Canada Revenue Agency successfully receives your tax return, you should see a message similar to the following, along with a confirmation number.

-

If you are preparing two tax returns together

for spouses or common-law partners, you

must proceed further in the interview, and follow the above steps to use NETFILE for the other spouse's or common-law partner's tax return as well.